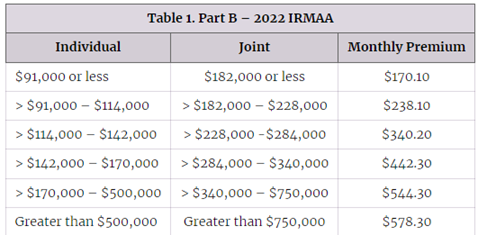

Typically, the subject of Medicare doesn’t pop up on anyone’s radar until they’re near age 65. By then, they know they will be required to pay a baseline Medicare Part B premium ($177.10 in 2022). However, depending on your income from two years prior, you could be in for an unpleasant surprise. If at age 63, your modified adjusted gross income (MAGI) was more than $91,000 ($182,000 for married couples), your Medicare Part B premium starts to increase. If you fall into one of the higher tax brackets between age 63 and 65, you could pay up to $578.30, nearly triple the baseline premium!

As the table below illustrates, premium increases can be very steep. The table does not include the Medicare Part D (prescriptions) IRMAA, added in 2010 as part of the Affordable Care Act.

Source: Centers for Medicare & Medicaid Services (CMS)

Keeping in mind that the IRMAA assessment is based on the two years prior, at some point, your income will likely fall within the lower brackets, triggering a premium reduction. Until then, though, the IRMAA tax could cost you thousands of dollars. However, with proper planning done well before you become Medicare eligible, you can mitigate the tax or avoid it altogether.

Planning for IRMAA

If you have more than two years to plan for your initial IRMAA assessment—which is issued when you first sign up for Medicare and then issued every November—there are a number of strategies to consider around shifting or reducing your MAGI (which includes taxable Social Security benefits and tax-exempt income), including:

- Complete a Roth conversion before age 63

- Realize capital losses to lower AGI

- Contribute to a Health Savings Account, if eligible

- Hold lower income-producing funds and securities in a brokerage account

- Delay collecting Social Security until age 70

- Set up Qualified Charitable Distributions to reduce MAGI post-age 70

- Plan for the timing of large expenses that you may dip into your taxable IRA for

Any IRMAA planning strategy you use should be evaluated as part of your overall financial plan. Still, the key is understanding where your MAGI lines up with the IRMAA brackets and what forms of income can be excluded. It’s always a good idea to talk to a tax professional as well.

What if You’re at or near Medicare Eligibility?

If you are at or near (within two years) Medicare eligibility, these planning strategies can still work for future years if your MAGI still exceeds the IRMAA thresholds. However, if your income falls drastically after age 65, you aren’t necessarily stuck with the IRMAA premium tax. You can appeal to Medicare if your decrease in income results from a life-changing event, such as marriage, divorce, death of a spouse, work stoppage, work reduction, or loss of income. You can also appeal if you suspect the IRS made an error in calculating your MAGI.

If you qualify for an appeal based on one of these events, you can print out form SSA-44 (Medicare Income-Related Monthly Adjustment Amount) and submit it to the Social Security Administration. The website includes the steps to follow for updating their income information, including the documentation required as evidence of the income change. You should provide as much official documentation as you can, along with a cover letter.

If your appeal is approved, the Social Security Administration will correct their Medicare Part B and D premium amounts and make it retroactive for the months you paid the higher premiums. If the appeal is denied, you will receive instructions for appealing the denial to an Administrative Law Judge.

Get Help Before It’s Too Late

If your circumstances put you in the crosshairs of an IRMAA tax bump, you should explore possible planning strategies right away. Your best course of action is to work with a financial advisor who understands the implications of IRMAA on your circumstances as well as the implications of any of the planning strategies mentioned above.

If you need help planning for Medicare costs or understanding how it will fit into your overall retirement plan, schedule a meeting today. Or, call our office at 608-563-2437.

Sheena is a highly regarded financial professional known for her clear explanations and practical advice on complex financial matters. She earned her CERTIFIED FINANCIAL PLANNER™️ designation in 2010 and holds a Bachelor of Science degree in Finance from the University of Wisconsin LaCrosse.