The True Cost of Owning a Second Home in Retirement

Retirement is full of wonderful possibilities. When you don’t have to show up at the office, you can spend your days just about anywhere you please. Maybe you’ve always pictured yourself at the beach or […]

Read More

Are Roth Conversions Going Away? Ideal Timing Insights (2024)

In the world of retirement planning, Roth IRA conversions are a standout strategy with huge potential tax savings! But here’s the thing: changes in legislation may be around the corner, potentially putting these opportunities at […]

Read More

Beyond the 401k: The “Where to Invest Next” Order of Operations

The goal of retirement is to live out your golden years in comfort, correct? Then it’s critical to make the most of your retirement savings strategy. And for many, contributing to an employer-sponsored 401k plan […]

Read More

Should Couples Retire Together or Separately?

After spending decades working hard and earning paychecks, it seems like a given that a married couple would want to sail off into the sunset to enjoy their new enriching life together. However, it may […]

Read More

A Financial Wellness Check: Preparing for a Prosperous New Year

As we approach the end of the year, there is no more critical time for planning your finances. It’s your last opportunity to review where you are with your 2023 goals and your best opportunity […]

Read More

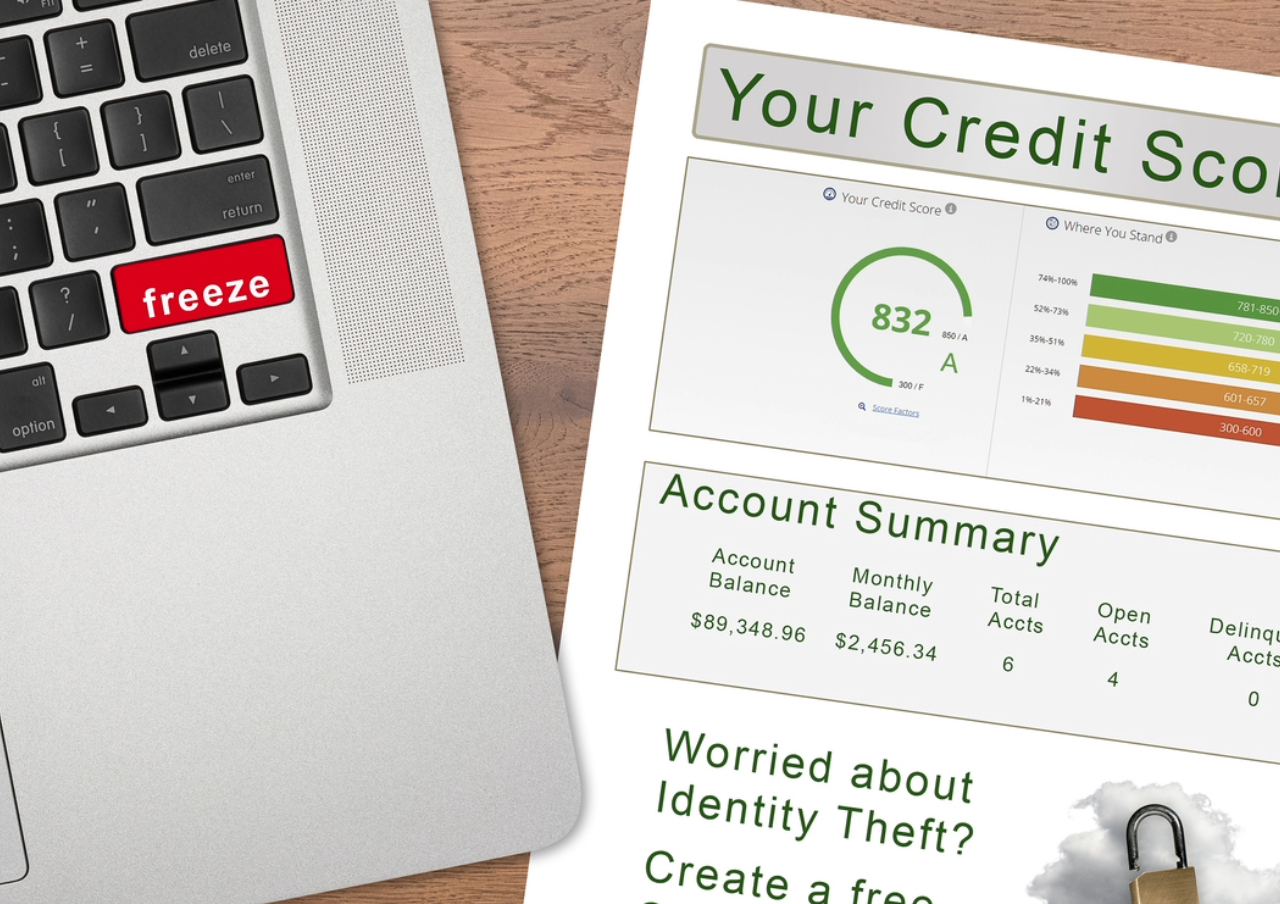

Credit Freeze: What is it and When Does it Makes Sense?

If you’ve applied for credit or a job, you know how essential your credit report is. Lenders rely heavily on them for evaluating your financial history to determine if you qualify for a loan or […]

Read More

Using Tax-Loss Harvesting to Minimize Capital Gains Taxes

So far, in 2023, investors are enduring a bit of a roller coaster ride, with stocks producing gains through mid-year and sliding into losses toward yearend. While stock market downturns are inevitable, there’s no way […]

Read More

10 Benefits of Dollar Cost Averaging

Concerns about volatility and competing demands for your money can make investing challenging. Dollar cost averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the […]

Read More

Your Final Gift: A Checklist for End-of-Life Planning

Peace of mind is a final gift you can give your loved ones—affording them the knowledge of your end-of-life wishes. Creating a plan for your loved ones when you die is an essential part of […]

Read More

5 Tips for Choosing the Right Health Insurance Plan During Open Enrollment (Medicare)

The complex Medicare landscape makes enrollment a daunting process. There are so many options to consider, each with its own medical and financial implications. Whether you’re new, or reassessing a current plan, the Open Enrollment […]

Read More